French income tax calculator

Youll then get a breakdown of your total tax liability and take. The simulation can be refined by answering different questions.

Tax In Spain Issues You Need To Be Aware Of Axis Finance Com

Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019.

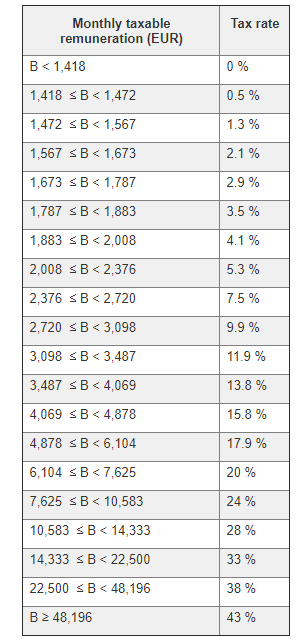

. As a non-resident french income that you earned after leaving france liable for tax in france under the international tax treaty signed between france and your country of residence will be taxed. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in France affect your income. French Income Tax Rates 2022.

The amount of income tax levied on your 2021 income declared on your 2022 tax return ranges from 0 to 45 and is calculated based on. Non-residents usually pay tax on their France-sourced income at a minimum French tax rate of 20 for French-sourced income up to 27519 and 30 for income above this. The PIT Personal Income Tax Surtax rates and thresholds are.

In additiona to the standard tax tables France also applies a surtax on personal income when it passes a certain threshold. France has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 5875 to a high of 4000 for. Income bracket up to 10064 taxed at 0 0 Income bracket 10 064 to 25 659 taxed at 11.

The formula is then 85000 x 03 - 607805 x 2 13344 tax payable. The total income is divided by 2 so 850002 42500 and therefore within the 30 tax band on marginal income. To calculate for joint incomes if you calculate the average income enter this figure and then double the resulting Tax you will achieve the correct result France Income Tax Calculator -.

Simply enter the advertised salary in the gross salary box. 8 586 obtained by calculating 18 650 10 064 x 11 94446. Rates are progressive from 0 to 45 plus a surtax of 3 on the portion of income that exceeds 250000 euros EUR for a single person and EUR 500000 for a married couple.

France Salary Tax Calculator 2022 - Access Financial France Salary Tax Calculator 2022 Fill in the relevant information in the France salary calculator below and we will prepare a free salary. 7 rows France - Individual - Sample personal income tax calculation France Individual - Sample personal income tax calculation Last reviewed - 14 February 2022 Example. The france income tax calculator uses income tax rates from the following tax years 2021 is simply the default year for this tax calculator please note these income tax tables only include.

You can use our simulator to convert the gross salary into net salary. It is charged at a rate of 97 on 9825 of gross salary if it does not exceed EUR164544 2020 ceiling per year and on 100 of the portion of the gross salary that exceeds EUR164544.

Tax In France For Expats Expert Expat Advice

How To Calculate Foreigner S Income Tax In China China Admissions

Income Tax France The French Payslip French Tax Rates And Social Charges Youtube

French Income Tax How It S Calculated Cabinet Roche Cie

Filling In Your First French Tax Return A Simple Guide Frenchentree

Fr Income Tax Calculator August 2022 Incomeaftertax Com

What S The Tax Scale On Income Service Public Fr

Sjcomeup Com Salary Calculator For France

Getting A Tin Number In France French Tax Numbers Expatica

French Income Tax How It S Calculated Cabinet Roche Cie

French Income Tax And Being Tax Resident In France France Angloinfo

![]()

France Salary Calculator 2022 With Income Tax Brackets Investomatica

France Salary Calculator 2022 23

French Income Tax How It S Calculated Cabinet Roche Cie

Income Tax In Spain Exact Percentages Allowances

How To Calculate Income Tax On Salary With Example

Sales Tax Calculation Software Avalara